Dividend Distribution Tax Rate For Ay 2025-25 25th March. The country of the company paying the dividend; Tax on dividend income is a tax that investors should pay under section 194 of the income tax act of 1961 on the income they generate from dividends.

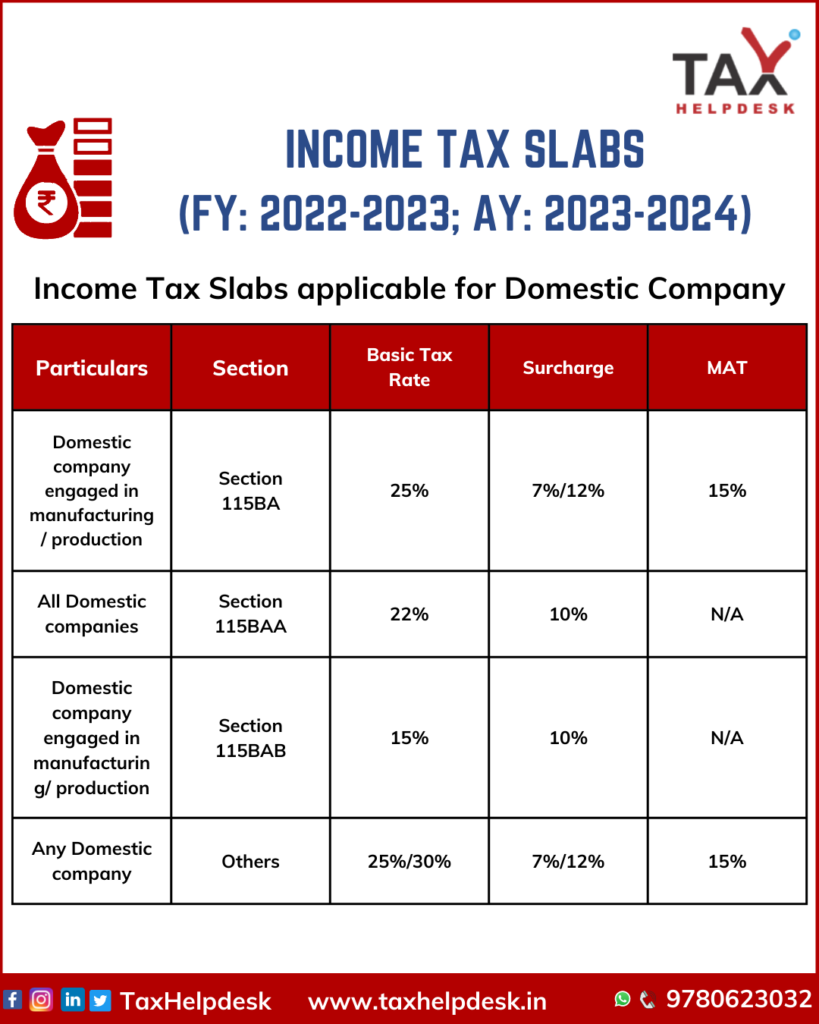

Dividend distribution tax is a tax on domestic company distributing dividend. Visit our site for more details.

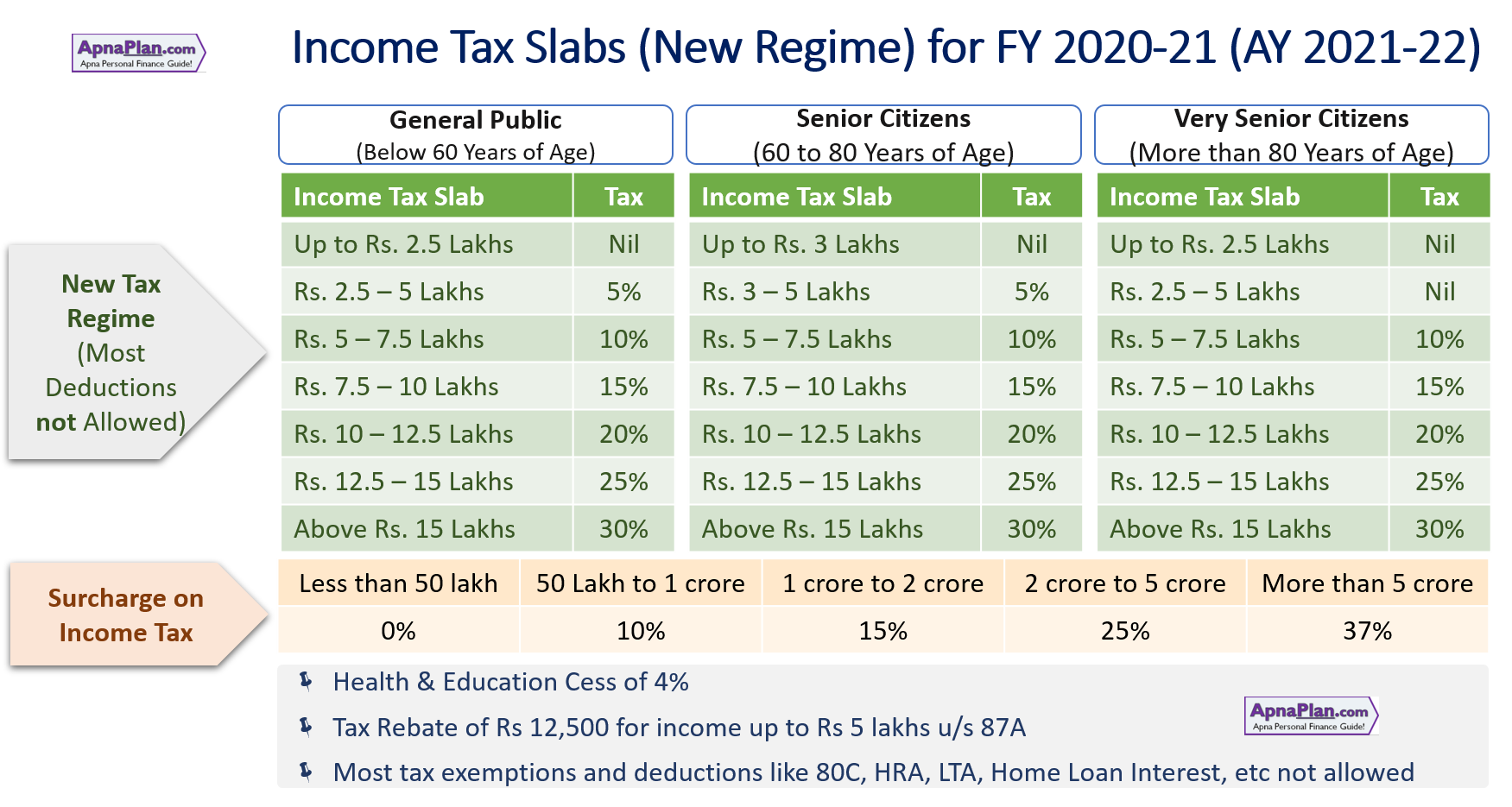

Tax Rates For Ay 202525 Old Regime Elle Nissie, The content on this page is only to give an overview / general guidance and is not.

New Slab Rate For Ay 202525 New Tax Regime Celine Allissa, Tax deduction at source (tds) is a crucial income tax compliance.

New Regime Tax Calculator Ay 202525 Vina Aloisia, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

Standard Deduction For Ay 202525 New Regime Malia Deloris, Know how to calculate and who has to pay ddt.

Latest TDS Rates AY 202525 Chart TDS Table FY 202524, An individual has to choose between new and.

New Tax Regime Slab Rate For Ay 202524 Tedi Abagael, Understand the abolition of dividend distribution tax (ddt) and the taxation of dividend.